Overview

Macroeconomics refers to the study of the overall performance of the economy. Macroeconomics

deals with the overall aggregate effect of microeconomics. Macroeconomics is crucial

for the government to understand and predict the long-term consequences of their

decisions.

Summary

- Macroeconomics refers to the study of the aggregate economy.

- The primary goals of macroeconomics are to achieve stable economic growth and maximize

the standard of living.

- Economic indicators are a good source of information to track macroeconomic performance.

- Monetary policy and fiscal policy are tools used by the government to control economic

performance and reach macroeconomic goals.

Goals of Macroeconomics

The overarching goals of macroeconomics are to maximize the standard of living and

achieve stable economic growth. The goals are supported by objectives such as minimizing

unemployment, increasing productivity, controlling inflation, and more. The macroeconomy

of a country is affected by many forces, and as such, economic indicators are invaluable

to assessing different aspects of performance.

Macroeconomic Factor

A macroeconomic factor is a pattern, characteristic, or condition that emanates

from, or relates to, a larger aspect of an economy rather than to a particular population.

The characteristic may be a significant economic, environmental, or geopolitical

event that widely influences a regional or national economy.

A macroeconomic factor can include something that affects the course or direction

of a given large-scale economy. Monetary policies and other regulations, for example,

can affect national and state economies, while also coming with potentially great

global consequences.

Inflation, gross domestic product (GDP), national income, and unemployment levels

are examples of macroeconomic factors. Such economic performance metrics are closely

tracked by states, companies, and consumers alike. The correlation between various

macroeconomic factors is extensively researched in the field of macroeconomics.

Inflation

Inflation is a progressive increase in the average cost of goods and services in

the economy over time.

Economic Growth Rate

The economic growth rate is the percent change in the cost of the output of goods

and services in a country across a specific period of time, relative to a previous

period.

Price Level

A price level is the variation of existing prices for economically produced goods

and services. In broader terms, the level of prices refers to the costs of a good,

service, or security.

Gross Domestic Product (GDP)

The gross domestic product (GDP) is a quantitative measure of the market value of

all finished goods and services produced over a given time period.

National Income

National income is the aggregate amount of money generated within a nation.

Unemployment Level

The level or rate of unemployment is the unemployed share of the labor force in

a given country, calculated and stated as a percentage.

Types of Macroeconomic Factors

1Positive

Positive macroeconomic factors are comprised of events that ultimately stimulate

economic stability and expansion within a country or a group of countries.

Any development leading to a rise in demand for goods or services (e.g., a decrease

in price) is considered a positive macroeconomic factor. As the demand for products

and services grows, domestic and foreign suppliers of the products will inevitably

benefit from increased revenues resulting from increased customer traffic. Higher

profits will, in effect, grow stock prices on a larger scale.

2Negative

Negative macroeconomic factors include events that may threaten the national or

global economy.

Concerns of political uncertainty induced by the involvement of a nation in civil

or global conflict are likely to worsen economic unrest due to the redistribution

of resources or damage to property, assets, and livelihoods. Negative macroeconomic

factors also include global pandemics (e.g., Covid-19) or natural disasters, such

as hurricanes, earthquakes, flooding, wildfires, etc.

3Neutral

Some economic changes are neither positive nor negative. Instead, the exact consequences

are assessed based on the purpose of the action, such as the control of trade across

regional or national borders.

The nature of a particular action, such as the implementation or discontinuance

of a trade embargo, would come with a variety of consequences that are dependent

on the country being impacted and the objectives behind the action taken.

Importance of Macroeconomic Factors

Economic experts and researchers frequently refer to macroeconomic factor trends

as they try to find ways to clarify economic policy objectives and strive to achieve

economic prosperity. They also attempt to forecast future rates of employment, inflation,

and other main macroeconomic factors. Such forecasts affect the decisions taken

by states, individuals, and businesses.

Gross Domestic Product

It's not just size, growth also matters

What is the GDP Formula?

There are two primary methods or formulas by which GDP can be determined:

1Expenditure Approach

The expenditure approach is the most commonly used GDP formula, which is based on

the money spent by various groups that participate in the economy.

GDP = C + G + I + NX

C = consumption or all private consumer spending within a country’s economy,

including, durable goods (items with a lifespan greater than three years), non-durable

goods (food & clothing), and services.

G = total government expenditures, including salaries of government employees,

road construction/repair, public schools, and military expenditure.

I = sum of a country’s investments spent on capital equipment, inventories,

and housing.

NX = net exports or a country’s total exports less total imports.

2Income Approach

This GDP formula takes the total income generated by the goods and services produced.

GDP = Total National Income + Sales Taxes + Depreciation + Net Foreign Factor Income

Total National Income – the sum of all wages, rent, interest, and profits.

Sales Taxes – consumer taxes imposed by the government on the sales of goods

and services.

Depreciation – cost allocated to a tangible asset over its useful life.

Net Foreign Factor Income – the difference between the total income that

a country’s citizens and companies generate in foreign countries, versus the total

income foreign citizens and companies generate in the domestic country.

What are the Types of GDP?

GPD can be measured in several different ways. The most common methods include:

- Nominal GDP – the total value of all goods and services produced at current

market prices. This includes all the changes in market prices during the current

year due to inflation or deflation.

- Real GDP – the sum of all goods and services produced at constant prices.

The prices used in determining the Gross Domestic Product are based on a certain

base year or the previous year. This provides a more accurate account of economic

growth, as it is already an inflation-adjusted measurement, meaning the effects

of inflation are taken out.

- Actual GDP – real-time measurement of all outputs at any interval or any

given time. It demonstrates the existing state of business of the economy.

- Potential GDP – ideal economic condition with 100% employment across all

sectors, steady currency, and stable product prices.

Why is GDP Important to Economists and Investors?

Gross Domestic Product represents the economic production and growth of a nation

and is one of the primary indicators used to determine the overall well-being of

a country’s economy and standard of living. One way to determine how well a country’s

economy is flourishing is by its GDP growth rate. This rate reflects the increase

or decrease in the percentage of economic output in monthly, quarterly, or yearly

periods.

Gross Domestic Product enables economic policymakers to assess whether the economy

is weakening or progressing, if it needs improvements or restrictions, and if threats

of recession or inflation are imminent. From these assessments, government agencies

can determine if expansionary, monetary policies are needed to address economic

issues.

Investors place importance on GDP growth rates to decide how the economy is changing

so that they can make adjustments to their asset allocation. However, when there

is an economic slump, businesses experience low profits, which means lower stock

prices and consumers tend to cut spending. Investors are also on the lookout for

potential investments, locally and abroad, basing their judgment on countries’ growth

rate comparisons.

What are Some Drawbacks of GDP?

Gross Domestic Product does not reflect the black market, which may be a large part

of the economy in certain countries. The black market, or the underground economy,

includes illegal economic activities, such as the sale of drugs, prostitution, and

some lawful transactions that don’t comply with tax obligations. In these cases,

GDP is not an accurate measure of some components that play a large role in the

economic state of a country.

Income generated in a country by an overseas company that is transferred back to

foreign investors is not taken into account. This overstates a country’s economic

output.

Gross Domestic Product (GDP) is the most common measure to estimate the size of

a country’s economy. It represents the total value of final goods and services produced

domestically, in a given time period. India’s GDP was approximately USD 2.3 trillion

for financial year 2015. What this means is that the total value of final goods

and services produced inside the geographical boundary of India between April 2014

and March 2015 was USD 2.3 trillion.

GDP calculation only includes value of final goods and services, as the value of

intermediary goods & services will automatically be included in the final price.

For example, GDP doesn’t include the value/price of a computer chip, as the same

is included in price of a computer when it is sold. When calculating GDP, all end

goods and services manufactured within the country is considered, regardless of

the country of origin of the manufacturing company. So the value of a Samsung mobile

manufactured in India will be included in GDP, even though Samsung is a foreign

company.

GDP growth rate is the percentage change in GDP, compared to the previous financial

year. It is commonly used to see how many additional goods and services were produced,

compared to the previous year. It is also helpful in comparing two different economies.

If GDP growth rate of India is 7.5% and that of China is 7.0%, it means that Indian

economy is expanding faster than China’s. However, this does not tell us anything

about the overall size of the economy – which is measured by the absolute GDP number.

Let us consider a small example to understand this.

Suppose, last year, India’s GDP was USD 1000 and GDP of china was USD 10,000. This

year, GDP growth rate of India is 9% and that of China is 6%. This means, the value

of additional goods and services produced by India is USD 90 (9%*1,000) and that

in China is USD 600 (6%*10,000). Thus, we can say that India is expanding rapidly,

but the absolute value of additional goods and services, produced by India, is still

less than China’s because of China’s higher base (previous year’s GDP).

GDP per capita is defined as the total GDP divided by the total population. A higher

GDP per capita signifies a higher living standard, as more number of goods and services

are available for each individual within the country.

Inflation

There are different types of inflations like:

- Creeping Inflation

- Galloping Inflation

- Hyperinflation

- Stagflation and

- Deflation.

Inflation measures how much more expensive a set of goods and services has become

over a certain period, usually a year

Inflation is an economic concept that refers to increases in the price level of

goods over a set period of time. The rise in the price level signifies that the

currency in a given economy loses purchasing power (i.e., less can be bought with

the same amount of money).

The causes for inflation in the short term and medium term remain a contested issue

among economists all over the world. However, there is a consensus that, in the

long term, inflation is caused by changes in the money supply.

How is Inflation Calculated?

Inflation is most commonly calculated by observing changes in price indices. Generally,

changes in the Consumer Price Index (CPI) are used as a proxy for inflation. Let’s

say that the CPI for a given nation was 210 at the end of 2017 (the base year) and

220 at the end of 2018. Calculating the percent change in those values will provide

us with the inflation over this time period:

Inflation= (220-210/210)* 100 =4.76%

Thus, we can conclude that inflation was approximately 5% in 2018.

If inputs to produce high-demand, inelastic goods (such as oil or medication) increase

in price, suppliers will be compelled to raise their prices to compensate. This

can be due to a number of reasons, such as environmental catastrophes, tariffs,

government sanctions, or scarcity. If widespread enough, the phenomenon can nudge

the CPI higher, resulting in inflation.

The opposite is also true – whereby lower input costs can result in deflation.

How Does Consumer Demand Affect Inflation?

Holding other factors the same, a rise in consumer demand for goods will lead to

an increase in the price of goods (CPI), as shown below:

Consumer demand for goods may increase due to various factors, such as changes in

consumer appetite, long-term scarcity prospects, or an increase in the money supply.

The opposite is also true; a decrease in consumer demand will result in a lower

CPI, and thus deflation.

How Does Money Supply Affect Inflation?

In the long run, money supply affects the purchasing power of a currency as per

supply and demand rules. The diagram below illustrates how an increase in the money

supply in an economy would affect inflation:

The money supply can increase in a variety of ways, namely if governments print

more money or make credit more easily accessible. Lower interest rates may spur

consumer borrowing and lead to an increase in the money supply. In the diagram above,

we can see that an influx of money in an environment where demand remains the same

will result in a devaluation of the currency in question.

The opposite is also true; if governments restrict the money supply and all else

remains constant, the currency will begin to appreciate in value.

Effects of Inflation

1 Decrease in unemployment

When the price of goods increase, so will revenues and, subsequently, profits for

private enterprises. The influx of capital will enable businesses to expand their

operations by hiring more employees.

2 Decrease in the real value of debt

As explained above, inflation is associated with a decrease in interest rates. Low

interest rates will cause the value of debt and related debt instruments to decrease.

This may incentivize consumer spending as consumers may be more inclined to take

on more debt during the period. On the other hand, businesses may struggle to sell

bonds to finance their operations, as bonds would become less attractive investments.

Investing in FDs thinking you will earn 8% returns?

From an individual investor’s perspective, inflation is one of the most important

indicators to understand and track. Inflation indicates an overall increase in the

general price level of goods and services in a country. When we read that last year

inflation was 7%, it doesn’t mean that price of every product like milk, cars, clothes,

etc., increased by 7%. It means compared to the previous year on average prices

of all goods and services increased by 7%.

Each one of us would have definitely experienced the impact of inflation in our

lives. In 90s, our overall college education fees never used to be more than few

thousand rupees, but now it’s always in lakhs and crores. We know that since our

childhood, prices of almost all goods and services have jumped manyfold. Let’s take

a basic example:

Example1 If your current monthly expenses are `30,000/- per month, then after

20 years you will require `80,000/- a month to just maintain the same lifestyle!

Example 2 An education degree for your child which currently costs `20 lakh

could cost over `34 lakh after 11 years!

This example clearly shows how inflation reduces value of money. Over a period of

time, the same amount of money will buy less units of the same good, thereby reducing

the individual’s purchasing power. Hence it is very important to invest one’s money

and grow it.

Over the last decade, average inflation in India was around 8.4%. After-tax average

rate of return on fixed deposits (assuming tax @ 20%) was around 6.2%. Thus, by

investing in FDs you were actually reducing the value of your money by 2.2% every

year, instead of growing it.

Now that we know what inflation is, we need to understand what causes it. Inflation

depends on price, which is determined by demand and supply. So if people have more

money leading to more demand than supply, price increases. This is called demand

pull inflation and is caused by too much money chasing too few goods. On the other

hand, if supply is less compared to demand, again prices increase and cause inflation.

This is called supply push inflation.

Deflation

Deflation is a decrease in the general price level of goods and services. Put another

way, deflation is negative inflation. When it occurs, the value of currency grows

over time. Thus, more goods and services can be purchased for the same amount of

money.

Deflation is widely regarded as an economic “problem” that can intensify a recession

or lead to a deflationary spiral.

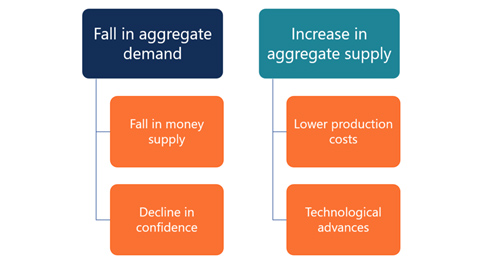

Causes of Deflation

Economists determine the two major causes of deflation in an economy as (1) fall

in aggregate demand and (2) increase in aggregate supply.

The fall in aggregate demand triggers a decline in the prices of goods and services.

Some factors leading to a decline in aggregate demand are:

1Fall in the money supply

A central bank may use a tighter monetary policy by increasing interest rates. Thus,

people, instead of spending their money immediately, prefer to save more of it.

In addition, increasing interest rates lead to higher borrowing costs, which also

discourages spending in the economy.

2Decline in confidence

Negative events in the economy, such as recession, may also cause a fall in aggregate

demand. For example, during a recession, people can become more pessimistic about

the future of the economy. Subsequently, they prefer to increase their savings and

reduce current spending.

An increase in aggregate supply is another trigger for deflation. Subsequently,

producers will face fiercer competition and be forced to lower prices. The growth

in aggregate supply can be caused by the following factors:

1 Lower production costs

A decline in price for key production inputs (e.g., oil) will lower production costs.

Producers will be able to increase production output, which will lead to an oversupply

in the economy. If demand remains unchanged, producers will need to lower their

prices on goods to keep people buying them.

2Technological advances

Advances in technology or rapid application of new technologies in production can

cause an increase in aggregate supply. Technological advances will allow producers

to lower costs. Thus, the prices of products will likely go down.

Effects of Deflation

Frequently, deflation occurs during recessions. It is considered an adverse economic

event and can cause many negative effects on the economy, including:

1 Increase in unemployment

During deflation, the unemployment rate will rise. Since price levels are decreasing,

producers tend to cut their costs by laying off their employees.

Increase in the real value of debt 2

Deflation is associated with an increase in interest rates, which will cause an

increase in the real value of debt. As a result, consumers are likely to defer their

spending.

Deflation spiral

This is a situation where decreasing price levels trigger a chain reaction that

leads to lower production, lower wages, decreased demand, and even lower price levels.

During a recession, the deflation spiral is a significant economic challenge because

it further worsens the economic situation.

Recession

Recession is a term used to signify a slowdown in general economic activity. In

macroeconomics, recessions are officially recognized after two consecutive quarters

of negative GDP growth rates

Causes of a Recession

1 Real factors

A sudden change in external economic conditions and structural shifts can trigger

a recession. This fact is explained by the Real Business Cycle Theory, which says

a recession is how a rational participant in the market responds to unanticipated

or negative shocks.

For example, a sudden rise in oil prices due to growing geopolitical tensions can

harm crude oil-importing economies. A revolutionary technology that causes automation

in factories can disproportionately impact economies with a huge pool of unskilled

labor.

2 Financial/Nominal factors

According to a school of economics called monetarism, a recession is a direct consequence

of over-expansion of credit during expansion periods. It gets exacerbated by insufficient

money supply and credit availability during the initial stages of a slowdown.

There is a significant correlation between monetary and real factors, such as interest

rates and relationships between certain goods. The relationship is not explicit

because monetary policy instruments such as interest rates also encompass institutional

responses to anticipated slowdowns.

3 Psychological factors

Psychological factors include excessive euphoria and overexposure to risky capital

during an economic expansion period. The 2008 Global Financial Crisis was, at least

in part, a result of irresponsible speculation that led to the formation of a bubble

in the housing market in the US. Psychological factors can also manifest as a curtailed

investment resulting from widespread market pessimism, which lacks grounds in the

real economy.

Stagflation

Stagflation is an economic event in which the inflation rate is high, economic growth

rate slows, and unemployment remains steadily high. Such an unfavorable combination

is feared and can be a dilemma for governments since most actions designed to lower

inflation may raise unemployment levels, and policies designed to decrease unemployment

may worsen inflation.

Causes of Stagflation

There is no consensus among economists on the causes of stagflation. Each economics

school offers its own view on its origins. However, two main theories may be derived:

supply shock and poor economic policies.

The supply shock theory suggests that stagflation occurs when an economy faces a

sudden increase or decrease in the supply of a commodity or service (supply shock),

such as a rapid increase in the price of oil. In such a situation, prices surge,

making production costlier and less profitable, thus slowing economic growth.

A second theory states that stagflation can be a result of a poorly made economic

policy. For example, the government can create a policy that harms industries while

growing the money supply too quickly. The simultaneous occurrence of these policies

can lead to slower economic growth and higher inflation.

Example of Stagflation

Stagflation is costly and difficult to eliminate, both in social and fiscal terms.

There could be many reasons, but the concept of “supply shock” allows us to understand

the causes of stagflation the best. Suppose tomorrow all oil producing nations decide

to cut supply and suddenly there is shortage of oil everywhere. Obviously the price

of oil will start increasing. Oil is the lifeblood of any economy as it is used

in various activities like transportation, power generation, manufacturing of goods

etc. Thus rising oil price will push up prices of all goods. Consider oranges, to

get farm produced oranges to a far off market, there is a huge transportation cost

involved which will increase with rising oil prices.

Stagflation is a situation where economy is stagnating, i.e. it is not experiencing

any GDP growth and at the same time there is also high inflation. It is a nightmare

situation for any country, as high prices kill purchasing power and harm the poor,

while low or negative GDP growth worsens the situation by causing unemployment.

Unemployment

The Curse of Joblessness

The number of people at work is generally closely related to whether an economy

is growing at a reasonable rate

Unemployment is a term referring to individuals who are employable and actively

seeking a job but are unable to find a job. Included in this group are those people

in the workforce who are working but do not have an appropriate job. Usually measured

by the unemployment rate, which is dividing the number of unemployed people by the

total number of people in the workforce, unemployment serves as one of the indicators

of a country’s economic status.

Back in the depths the global financial crisis in 2009, the International Labour

Office announced that global unemployment had reached the highest level on record.

t was not a coincidence that the global economy experienced the most severe case

of unemployment during the worst economic crisis since the Great Depression. Unemployment

is highly dependent on economic activity; in fact, growth and unemployment can be

thought of as two sides of the same coin: when economic activity is high, more production

happens overall, and more people are needed to produce the higher amount of goods

and services. And when economic activity is low, firms cut jobs and unemployment

rises. In that sense, unemployment is countercyclical, meaning that it rises when

economic growth is low and vice versa.

But unemployment does not fall in lockstep with an increase in growth. It is more

common for businesses to first try to recover from a downturn by having the same

number of employees do more work or turn out more products—that is, to increase

their productivity. Only as the recovery takes hold would businesses add workers.

As a consequence, unemployment may start to come down only well after an economic

recovery begins. In fact, in the last three recessions, the unemployment rate continued

to rise after the end of the recessions; a phenomenon called “jobless recoveries.”

The phenomenon works in reverse at the start of a downturn, when firms would rather

reduce work hours, or impose some pay cuts before they let workers go. Unemployment

starts rising only if the downturn is prolonged. Because unemployment follows growth

with a delay, it is called a lagging indicator of economic activity.

How sensitive is the unemployment rate to economic growth? That depends on several

factors, most notably labor market conditions and regulations.

Generally high unemployment rate signals recession and problems with the economy.

Thus it is very important to observe and track unemployment levels in an economy

to determine its health.

Business Cycle

A business cycle is a cycle of fluctuations in the Gross Domestic Product (GDP)

around its long-term natural growth rate. It explains the expansion and contraction

in economic activity that an economy experiences over time.

A business cycle is completed when it goes through a single boom and a single contraction

in sequence. The time period to complete this sequence is called the length of the

business cycle. A boom is characterized by a period of rapid economic growth whereas

a period of relatively stagnated economic growth is a recession. These are measured

in terms of the growth of the real GDP, which is inflation-adjusted.

Stages of the Business Cycle

In the diagram above, the straight line in the middle is the steady growth line.

The business cycle moves about the line. Below is a more detailed description of

each stage in the business cycle:

1 Expansion

The first stage in the business cycle is expansion. In this stage, there is an increase

in positive economic indicators such as employment, income, output, wages, profits,

demand, and supply of goods and services. Debtors are generally paying their debts

on time, the velocity of the money supply is high, and investment is high. This

process continues as long as economic conditions are favorable for expansion.

2 Peak

The economy then reaches a saturation point, or peak, which is the second stage

of the business cycle. The maximum limit of growth is attained. The economic indicators

do not grow further and are at their highest. Prices are at their peak. This stage

marks the reversal point in the trend of economic growth. Consumers tend to restructure

their budgets at this point.

3 Recession

The recession is the stage that follows the peak phase. The demand for goods and

services starts declining rapidly and steadily in this phase. Producers do not notice

the decrease in demand instantly and go on producing, which creates a situation

of excess supply in the market. Prices tend to fall. All positive economic indicators

such as income, output, wages, etc., consequently start to fall.

4 Depression

There is a commensurate rise in unemployment. The growth in the economy continues

to decline, and as this falls below the steady growth line, the stage is called

a depression.

5 Trough

In the depression stage, the economy’s growth rate becomes negative. There is further

decline until the prices of factors, as well as the demand and supply of goods and

services, contract to reach their lowest point. The economy eventually reaches the

trough. It is the negative saturation point for an economy. There is extensive depletion

of national income and expenditure.

5 Recovery

After the trough, the economy moves to the stage of recovery. In this phase, there

is a turnaround in the economy, and it begins to recover from the negative growth

rate. Demand starts to pick up due to low prices and, consequently, supply begins

to increase. The population develops a positive attitude towards investment and

employment and production starts increasing.

Employment begins to rise and, due to accumulated cash balances with the bankers,

lending also shows positive signals. In this phase, depreciated capital is replaced,

leading to new investments in the production process. Recovery continues until the

economy returns to steady growth levels.

This completes one full business cycle of boom and contraction. The extreme points

are the peak and the trough.

Indexation

The profit that you make on selling a long-term capital asset is called a long-term

capital gain. But as you know, inflation erodes the value of money. For instance,

the value of Rs 100 was worth more 10 yrs ago than what it is today. That is why

when computing the gains on selling a capital asset, it is important to adjust the

purchase price to account for inflation.

This is done by way of indexation, a method used to reduce tax liability on selling

a capital gain. Indexation accounts for inflation from the year of purchase of an

asset to the year of sale.

How does indexation work?

It inflates the purchase price of an asset by accounting for inflation until the

year of the sale

It reduces the capital gains you earn on selling an asset

Finally, it brings down your tax on capital gains

Before looking at an example, let us understand what are capital assets and capital

gains.

- Capital asset: This is an asset that you hold for over a year with an intention

to not to resell but derive benefits from it for a longer period of time. These

can be financial securities, real estate, and so on in the form of short- or long-term

assets. But for the purpose of indexation, we shall focus on long-term capital assets—held

for 12 to 36 months depending on the asset class.

- Capital gain The profit you earn on selling a capital asset after you have

held it for a minimum holding period is called a capital gain. So when you sell

a residential property after holding it for at least 3 yrs, the profit you make

thereon is a long-term capital gain. Simply put, a capital gain is a difference

between the sale price and the purchase price of a capital asset. As with any other

taxable income, long-term capital gain also attracts income tax.

For instance, if you had bought a residential property for Rs 10 lakh in Mar 2003

and sold it for Rs 35 lakh in Mar 2020, then you have earned a capital gain of Rs

25 lakh. Here, the property is a long-term capital asset and the profit is long-term

capital gain, which attracts income tax. Assuming the rate of tax on long-term capital

gains is 10%, your tax liability on the sale of the property would be Rs 2,50,000!

But thanks to indexation, you don’t have to pay tax on Rs 25 lakh. Here’s why.

As mentioned, indexation inflates the purchase price of an asset. Keeping the sale

price of the asset constant, a lower purchase price increases your capital gain

and tax liability. On the contrary, a higher purchase price decreases long-term

capital gain and tax thereon. For this purpose, you ascertain the indexed cost of

acquisition. Meaning adjusting Rs 10 lakh for inflation over 17 yrs of holding period

so it reflects today’s value.

The rate of inflation considered here is derived from the government’s Cost Inflation

Index (CII), available on the income tax department’s website. Once you have the

CII data, you can calculate the indexed cost of acquisition of the asset or its

inflation-adjusted value as follows:

Indexed cost of acquisition = Original cost of acquisition x (CII of the year of

the sale/CII of year of purchase)

In our example, the indexed cost of acquisition of the residential property = Rs

10 lakh x (280/105) = Rs 26,66,667

Effectively, the capital gains will now be Rs 8,33,333 (Rs 35,00,000 minus Rs 26,66,667)

as against Rs 25 lakh before indexation. Naturally, your tax on capital gain also

reduces to Rs 83,333 as against Rs 2,50,000 before indexation.

By now you may have understood the benefit of indexation. It helps reduce your long-term

capital gains and, in turn, brings down your overall taxable liability.

Interest Rates

Real Interest Rate,It's all relative

Interest rate is one of the most common economic terms that we use in daily life.

Simply put, interest rate is the return earned on money lent out. So if you lend

Rs 100 to your friend and ask her to give back Rs 110 after one year, interest rate

charged by you is 10%. Similarly, if you put Rs 100 in your bank account, the bank

will pay interest as in this case it’s the bank who is taking money from you. If

the bank offers an interest rate of 4%, then after one year you will get Rs 104

from the bank and will earn Rs 4 as interest.

This interest rate that we just discussed and the ones that we generally hear &

read about is called the nominal interest rate. Now let’s see why nominal interest

rate is not very relevant. The basic motive behind investing money is to earn returns/interest

that allows us to retain purchasing power as well as to grow the savings kitty.

This should allow us to improve our standard of living over a period of time. Let

us consider an example. Suppose, you have Rs 1,00,000 and want to buy a high-end

motor bike costing Rs 1,08,000. You decide to invest your money in a fixed deposit

at 9% interest rate. You thought that you will have Rs 1,09,000 at the end of the

year and will easily buy your favourite bike.

But after one year, you realize that the price of the bike has gone up to Rs 1,15,000

(increased by approx 6.5%). You are sad, as again you cannot buy the bike. What

really happened here? Due to general inflation of around 6.5% in the economy, price

of the bike increased proportionately during the course of the year. So in order

to achieve your target of buying the bike you should have invested in an instrument

that returned 15% after a year. That would have allowed you to beat inflation of

6.5% and in addition earn real returns of 8.5%.

Real Interest Rate = Nominal Interest Rate – Inflation Rate

In our example nominal interest rate is 9% and inflation is 6.5% and hence real

interest rate is 2.5% (9%- 6.5%). When we invest our money, some part of what we

are earning is always being eaten away by inflation.

Investors will be able to retain their purchasing power only when they earn returns

equal to or more than the inflation rate. Suppose the inflation rate is 9% and interest

rate is 8%, in real sense you will actually lose 1% of your money, rather than gain

anything. So rather than being able to buy more things after a year, you won’t even

be able to buy the same basket of goods bought earlier, as their market price will

be higher than your investment kitty.

Compared to savings bank accounts, fixed deposits, bonds and other instruments,

only equities as an asset class have generated positive real rate of return in the

last decade. To make money in real sense over the long term, invest in equities.

Currency Appreciation & Depreciation

Not too much, not too little.. just right

Let’s continue our discussion on currency market and movements that we started in

our previous article. We just understood what a currency market is and why currency

appreciates and/or depreciates. In this article let’s try to understand why this

upward/downward movement of currency is so important.

Suppose you want to import a costly laser machine from USA. The cost of machine

is USD 1000. Currently the conversion rate given to you by your dealer is USD 1

= INR 65. So as of today, you will have to spend INR 65,000 to buy this machine.

Due to some issues, you postpone your purchase and decide to buy it next month.

Meanwhile due to reasons beyond your control, USD appreciates. We know that USD

appreciation means INR depreciation. Thus, we will have to pay more in order to

buy each unit of Dollar. Now after one month, you again ask for a quote from your

dealer and he quotes USD 1 = INR 70. Thus, you will now have to pay more to import

the same machine because of USD appreciation (INR depreciation).

Let’s take another example. Suppose you manufacture cycles. You want to export one

cycle to US for INR 6000. The person importing this cycle in US will have to pay

in INR and thus asks for a quote from his dealer to buy INR. His dealer quotes 1USD

= 60 INR. So to buy INR 6000, he will have to spend USD 100 (6000/60). Just as in

previous example, he also faces some issues and postpones his purchase by one month.

After one month, you are again willing to sell the cycle at INR 6000, but suppose

USD appreciated. Now it becomes USD 1 = INR 65. Thus, the US buyer will only have

to pay USD 92.5, in order to buy the same product.

Above examples make it very clear that when foreign currency appreciates (domestic

currency depreciates), local goods become cheaper in other countries, as foreigners

will have to pay less to buy the same amount of INR. At the same time, it makes

foreign goods costly as you will have to pay more to buy each unit of foreign currency.

So when local currency depreciates, imports become costly and price of exported

goods becomes cheap for foreign nationals. As price of imported goods increases,

demand for imported article decreases and as price of goods exported becomes cheaper

for foreigners, foreign demand for local goods increases. Hence we can now conclude

that domestic currency depreciation leads to higher exports and lower imports. Opposite

will happen when domestic currency appreciates.

India is a major oil importer as it doesn’t produce sufficient crude oil to meet

its energy demands. Thus when rupee depreciates, it becomes more expensive for the

Government to import oil. Higher oil prices increases the overall price level, as

explained in our article on stagflation. Thus, it becomes important for many countries

to ensure that their currency doesn’t excessively depreciate. But if a country doesn’t

import many things, then it would want local currency to depreciate, so that local

goods become cheaper in other countries and exports increases. Countries with excessive

focus on exports use currency depreciation technique to boost their exports.

Value of Currency

Why currencies rise and fall

Foreign exchange market (FX, currency market) can be thought of as a global network

of banks and financial institutions, selling and buying currencies from each other;

an Indian bank buying Dollars by paying in Rupees, a European bank buying Rupees

by paying in Dollars etc. Suppose you are planning a trip to Australia and need

Aussie Dollars for being able to buy goods and services in Australia. You can go

to your local bank like HDFC/ICICI or a currency dealer and can buy Aussie Dollar

by paying in Rupees. Instead of an individual, suppose there is an Indian automobile

manufacturer who wants to import auto parts manufactured in Japan. The company will

have to pay in Japanese Yen to buy these auto parts. So it will buy Yen from a bank

or a dealer by paying in Rupee and then pay Yen to the company from which it is

buying these parts. Just like you and this company, there are hundreds of thousands

of individuals and companies around the world seeking foreign currency for various

reasons. They go to their banks and dealers for their needs and these banks and

dealers deal with each other to fulfill the needs of such individuals and companies.

Hence currency market can be described as an interconnected network of these institutions.

Every day in the newspapers, we keep reading that currency is falling or that the

government is doing nothing about currency deprecation etc. The natural question

is why is these so important that it needs so much of our attention and why does

currency actually fall or rise? First, let’s discuss the second part of our question.

Just like other goods and services, price of a currency is also determined by its

demand and supply. Suppose today price of USD 1 is Rs 62. Now assume, lot of Indians

suddenly start travelling to USA or many Indian companies start buying products

from the USA or many Indians start investing in the US in the hope of better opportunities,

all these activities will lead to greater demand for US Dollars from India. We have

already learnt that as demand for a product/service increases, price of the same

also increases. So now USD 1 becomes RS 65 ie we need to pay more, in order to buy

USD 1. In this example, USD appreciated with respect to Rupee by 4.84% [(65-62)/62].

In an opposite case when demand for USD decreases, its price will decrease and we

will have to pay less. Suppose USD 1 becomes equal to RS 60. In this case, USD depreciated

with respect to Rupee by 3.23% [(62-60)/62]. It is important to understand that

if demand for USD is increasing from India, it doesn’t mean that it’s increasing

from rest of the world as well. So USD might not appreciate against other currencies,

as its demand is increasing only against Rupee.

So when a currency appreciates, it means we need to pay more in order to buy 1 unit

of the currency. Similarly if currency depreciates, we need to pay less in order

to buy 1 unit. As you might have already noticed, price of one currency is given

in another currency. In our example, price of USD was given in Rupee. So when one

currency in the pair appreciates, another is depreciating simultaneously and vice

versa. Let’s say initially USD 1 = INR 60 or 1 INR = 1/60 USD. Now USD depreciates.

This means we will have to pay less to buy 1 USD. Suppose it becomes 1USD = 58 INR.

So INR 1 becomes USD 1/58. Initially we had to pay USD 1/60 to buy INR 1, but now

we will have to pay USD 1/58, which is more. Thus, Rupee appreciated when USD depreciated.

Hence, we say that for a currency pair, if one currency is appreciating, the other

depreciates and vice versa.

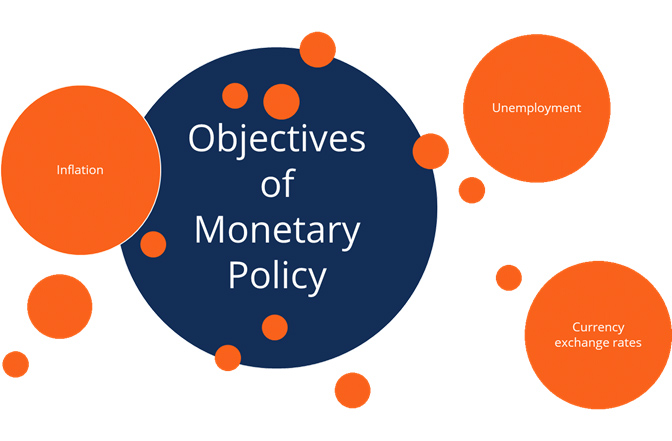

Monetary Policy

Monetary policy is an economic policy that manages the size and growth rate of the

money supply in an economy. It is a powerful tool to regulate macroeconomic variables

such as inflation and unemployment.

Monetary policy is the process by which the monetary authority of a country, generally

the central bank, controls the supply of money in the economy by its control over

interest rates in order to maintain price stability and achieve high economic growth.

In India, the central monetary authority is the Reserve Bank of India (RBI).

It is designed to maintain the price stability in the economy. Other objectives

of the monetary policy of India, as stated by RBI, are:

1 Price stability

Price stability implies promoting economic development with considerable emphasis

on price stability. The centre of focus is to facilitate the environment which is

favorable to the architecture that enables the developmental projects to run swiftly

while also maintaining reasonable price stability.

2Controlled expansion of bank credit

One of the important functions of RBI is the controlled expansion of bank credit

and money supply with special attention to seasonal requirement for credit without

affecting the output.

3Promotion of fixed investment

The aim here is to increase the productivity of investment by restraining non essential

fixed investment.

4Restriction of inventories and stocks

Overfilling of stocks and products becoming outdated due to excess of stock often

results in sickness of the unit. To avoid this problem, the central monetary authority

carries out this essential function of restricting the inventories. The main objective

of this policy is to avoid over-stocking and idle money in the organisation.

5Promoting efficiency

It tries to increase the efficiency in the financial system and tries to incorporate

structural changes such as deregulating interest rates, easing operational constraints

in the credit delivery system, introducing new money market instruments, etc.

6Reducing rigidity

RBI tries to bring about flexibilities in operations which provide a considerable

autonomy. It encourages more competitive environment and diversification. It maintains

its control over financial system whenever and wherever necessary to maintain the

discipline and prudence in operations of the financial system.

Monetary policy committee

The Reserve Bank of India Act, 1934 (RBI Act) was amended by the Finance Act, 2016,

to provide a statutory and institutionalised framework for a Monetary Policy Committee,

for maintaining price stability, while keeping in mind the objective of growth.

The Monetary Policy Committee is entrusted with the task of fixing the benchmark

policy rate (repo rate) required to maintain inflation within the specified target

level. As per the provisions of the RBI Act, three of the six Members of the Monetary

Policy Committee will be from the RBI and the other three Members will be appointed

by the Central Government.

The Government of India, in consultation with RBI, notified the 'Inflation Target'

in the Gazette of India Extraordinary dated 5 August 2016 for the period beginning

from the date of publication of the notification and ending on the March 31, 2021

as 4%. At the same time, lower and upper tolerance levels were notified to be 2%

and 6% respectively. Inflation rate in 2020 is 6.2% .

Monetary operations

Monetary operations involve monetary techniques which operate on monetary magnitudes

such as money supply, interest rates and availability of credit aimed to maintain

price stability, stable exchange rate, healthy balance of payment, financial stability,

and economic growth. RBI, the apex institute of India which monitors and regulates

the monetary policy of the country, stabilize the price by controlling inflation.

Instruments of monetary policy

These instruments are used to control the money flow in the economy:

1 Open market operations

An open market operation is an instrument of monetary policy which involves buying

or selling of government securities like government bonds from or to the public

and banks. This mechanism influences the reserve position of the banks, yield on

government securities and cost of bank credit. The RBI sells government securities

to control the flow of credit and buys government securities to increase credit

flow. Open market operation makes bank rate policy effective and maintains stability

in government securities market.

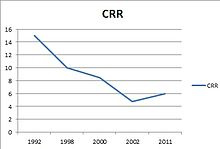

CRR graph from 1992 to 2011[3]

CRR graph from 1992 to 2011[3]

2Cash reserve ratio (CRR)

Cash reserve ratio is a certain percentage of bank deposits which banks are required

to keep with RBI in the form of reserves or balances. The higher the CRR with the

RBI, the lower will be the liquidity in the system, and vice versa. RBI is empowered

to vary CRR between 15 percent and 3 percent. Per the suggestion by the Narasimham

Committee report, the CRR was reduced from 15% in 1990 to 5 percent in 2002. As

of 21st may 2022, the CRR is 4.50 percent

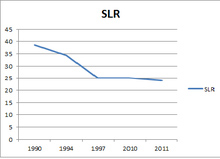

SLR graph from 1991 to 2011

SLR graph from 1991 to 2011

3Statutory liquidity ratio (SLR)

Every financial institution has to maintain a certain quantity of liquid assets

with themselves at any point of time of their total time and demand liabilities.

These assets have to be kept in non cash form such as G-secs precious metals, approved

securities like bonds. The ratio of the liquid assets to time and demand liabilities

is termed as the Statutory liquidity ratio. There was a reduction of SLR from 38.5%

to 25% because of the suggestion by Narsimham Committee. As on 9th October 2020,

the SLR stands at 18%

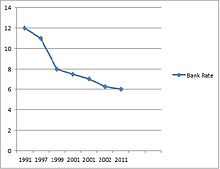

Bank rate graph from 1991 to 2011

Bank rate graph from 1991 to 2011

4Bank rate policy

The bank rate, also known as the discount rate, is the rate of interest charged

by the RBI for providing funds or loans to the banking system. This banking system

involves commercial and co-operative banks, Industrial Development Bank of India,

IFC, EXIM Bank, and other approved financial institutions. Funds are provided either

through lending directly or discounting or buying money market instruments like

commercial bills and treasury bills. Increase in bank rate increases the cost of

borrowing by commercial banks which results in the reduction in credit volume to

the banks and hence the supply of money declines. Increase in the bank rate is the

symbol of tightening of RBI monetary policy. As of 9th October 2020, the bank rate

is 4.25 percent.

5Credit ceiling

In this operation, RBI issues prior information or direction that loans to the commercial

banks will be given up to a certain limit. In this case, commercial bank will be

tight in advancing loans to the public. They will allocate loans to limited sectors.

A few examples of credit ceiling are agriculture sector advances and priority sector

lending.

6Credit authorisation scheme

Credit authorisation scheme was introduced in November, 1965 when P C Bhattacharya

was the chairman of RBI. Under this instrument of credit regulation, RBI, as per

the guideline, authorise the banks to advance loans to desired sectors.

7Moral suasion

Moral suasion is just as a request by the RBI to the commercial banks to take certain

actions and measures in certain trends of the economy. RBI may request commercial

banks not to give loans for unproductive purposes which do not add to economic growth

but increase inflation.

8Repo rate and reverse repo rate

Repo rate is the rate at which RBI lends to its clients generally against government

securities. Reduction in repo rate helps the commercial banks to get money at a

cheaper rate and increase in repo rate discourages the commercial banks to get money

as the rate increases and becomes expensive. The reverse repo rate is the rate at

which RBI borrows money from the commercial banks. The increase in the repo rate

will increase the cost of borrowing and lending of the banks which will discourage

the public to borrow money and will encourage them to deposit. As the rates are

high the availability of credit and demand decreases resulting to decrease in inflation.

This increase in repo rate and reverse repo rate is a symbol of tightening of the

policy. As of May 2022, the repo rate is 4.40% and the reverse repo rate is 3.35%

Latest RBI Bank Rates in Indian Banking - 2022

| SLR Rate

|

CRR

|

MSF

|

Repo Rate

|

Reverse Repo Rate

|

Base Rate

|

| 18%

|

3%

|

4.25%

|

4%

|

3.35%

|

8.15% - 9.40%

|

RBI Repo Rate Trend Chart

Repo rate also known as the benchmark interest rate is the rate at which the RBI

lends money to the banks for a short term. When the repo rate increases, borrowing

from RBI becomes more expensive. If RBI wants to make it more expensive for the

banks to borrow money, it increases the repo rate similarly, if it wants to make

it cheaper for banks to borrow money it reduces the repo rate. Current repo rate

is 4%

Reverse Repo rate is the short term borrowing rate at which RBI borrows money from

banks. The Reserve bank uses this tool when it feels there is too much money floating

in the banking system. An increase in the reverse repo rate means that the banks

will get a higher rate of interest from RBI. As a result, banks prefer to lend their

money to RBI which is always safe instead of lending it others (people, companies

etc) which is always risky.

Repo Rate signifies the rate at which liquidity is injected in the banking system

by RBI, whereas Reverse Repo rate signifies the rate at which the central bank absorbs

liquidity from the banks.

RBI joined other central banks and slashed the repo rate, reverse repo rate and

CRR to help maintain stability as a response to the Corona Virus crisis. In April

2020, RBI cut the reverse repo rate so banks will get lower interest rate which

will push them to give out more loans to the general public and companies. In May

2020, they slashed repo and reverse repo rate again. RBI also extended the moratorium

on payment of loans by another three months till August.

Fiscal Policy

Fiscal policy refers to the budgetary policy of the government, which involves the

government controlling its level of spending and tax rates within the economy. The

government uses these two tools to influence the economy. It is the sister strategy

to monetary policy. Although both fiscal policy and monetary policy are related

to government revenues and expenditures and both seek to correct situations of excess

or deficient demand in the economy, they do so in very different ways.

Origins of Fiscal Policy

Before the Great Depression, governments across the world followed the policy of

Laissez-faire (or Let it be). This approach to the economy was based on the teachings

of classical economists such as Adam Smith and Alfred Marshall. Classical economists

believed in the power of the invisible hand of the market. They were of the opinion

that the government should not interfere in the economy, as any interference in

the market was uncalled for.

However, the 1929 stock market crash that ushered in the Great Depression fundamentally

changed the course of economic thought. The Depression resulted in low economic

demand along with high unemployment. Classical economics could not provide any solution

to the crisis.

In 1936, British economist John Maynard Keynes published “The General Theory of

Employment, Interest, and Money” (known simply as “The General Theory”). In it,

Keynes called for an increase in government spending to combat the recessionary

forces in the economy. He believed that an increase in government spending would

bring about an increase in demand for commodities in the market.

Since Central bank is an autonomous body it is not under any obligation to follow

Government orders/directives. In such a scenario, how do Governments increase/decrease

money supply in the economy, independent of Central bank’s actions? Read on to know

more.

From our article on measuring GDP, we know that both consumption by households and

Government expenditure on public goods are used in calculating GDP. As consumption

and/or Government expenditure increases, GDP also increases. In order to know more

about how government increases/decreases money supply, first we need to understand

consumption and government expenditure in detail. Consumption is contingent on income

and higher the income, higher will be the consumption

How Does Fiscal Policy Work?

Proponents of Fiscal Policy utilization believe that public finance can influence

inflation and employment by manipulating two key variables:

- The level of government spending or the amount of money the government spends

- The tax rate or the amount of money the government earns

Government expenditure includes building schools, roads, bridges, ports etc. It

also includes expenditure on social welfare schemes as well as salaries paid to

various government employees. Whenever Government increases its expenditure, it

results in creation of more public goods or higher allocation to welfare schemes

like education or healthcare. This leads to increased income for labourers building

the road, teachers in the school or hospital workers. So we can conclude that increased

Government expenditure puts more money into the hands of the people or increases

their income, leading to higher GDP.

When government increases expenditure and reduces tax rate, it acts as a double

booster and transfers more money to individuals. This results in increased consumption

and higher GDP. Such policies are called expansionary fiscal policy. On the other

hand, increasing tax rate and reducing Government expenditure, takes away money

from individuals, lowering consumption and GDP. Such policies are called contractionary

fiscal policy.

This can also be understood through Government’s deficit. Tax represents Government’s

income and and it’s spending is the amount invested in creating public goods and

implementing welfare schemes. . If the Government is spending more than what it

earns, it will have a deficit. If the deficit is expanding, it could be because

of increasing expenditure, decreasing tax or both. In such cases, Government is

following an expansionary fiscal policy. Similarly, if Government deficit is decreasing,

it is following a contractionary fiscal policy.

Difference between Monetary Policy and Fiscal Policy

Monetary policy and fiscal policy are two different tools that have an impact on

the economic activity of a country.

Monetary policies are formed and managed by the central banks of a country and such

a policy is concerned with the management of money supply and interest rates in

an economy.

Fiscal policy is related to the way a government is managing the aspects of spending

and taxation. It is the government’s way of stabilising the economy and helping

in the growth of the economy.

Governments can modify the fiscal policy by bringing in measures and changes in

tax rates to control the fiscal deficit of the economy.

Below are certain points of difference between the monetary and fiscal policy

| Monetary Policy

|

Fiscal Policy

|

| Definition

|

| It is a financial tool that is used by the central banks in regulating the flow

of money and the interest rates in an economy

|

It is a financial tool that is used by the central government in managing tax revenues

and policies related to expenditure for the benefit of the economy

|

| Managed By

|

| Central Bank of an economy

|

Ministry of Finance of an economy

|

| Measures

|

| It measures the interest rates applicable for lending money in the economy

|

It measures the capital expenditure and taxes of an economy

|

| Focus Area

|

| Stability of an economy

|

Growth of an economy

|

| Impact on Exchange rates

|

| Exchange rates improve when there is higher interest rates

|

It has no impact on the exchange rates

|

| Targets

|

| Monetary policy targets inflation in an economy

|

Fiscal policy does not have any specific target

|

| Impact

|

| Monetary policy has an impact on the borrowing in an economy

|

Fiscal policy has an impact on the budget deficit

|